On September 16, 1992, George Soros executed one of the most legendary trades in financial history, earning over $1 billion in a single day.

At that time, the British pound was linked to the German Deutsche Mark through a fixed exchange rate system known as the European Exchange Rate Mechanism (ERM), a precursor to the euro currency. The ERM maintained exchange rates between participating European currencies by having governments actively buy or sell their respective currencies to keep them within pre-set limits.

Who is George Soros?

In short, George Soros is a Hungarian-American investor, philanthropist, and author. Born on August 12, 1930, in Budapest, Hungary, Soros survived the Nazi occupation during World War II before emigrating to England, where he studied at the London School of Economics. He later moved to the United States, where he founded the Soros Fund Management in 1970, achieving massive success as a hedge fund manager.

The Overvalued Pound

By 1991, it became evident to many that the British pound was overvalued within the confines of the ERM. The Bank of England’s interventions were the primary support for this valuation, with the central bank continually buying pounds to maintain the established exchange rate. Despite the unsustainable nature of this strategy, market sentiment largely believed that the Bank of England could uphold the pound’s value indefinitely.

Soros, however, had a different perspective. He recognized that if he could challenge the Bank of England’s resolve, it would force them to abandon the fixed exchange rate. This, in turn, would result in a significant profit for him and his hedge fund.

Soros’s Strategy and Execution

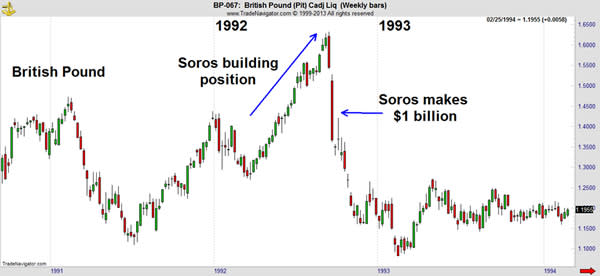

Soros planned to capitalize on the situation by shorting the pound, essentially betting on its depreciation. His strategy involved borrowing substantial amounts of pounds and then selling them for Deutsche Marks at the fixed rate. Should the pound’s value decrease, Soros could convert his Deutsche Marks back into pounds at a more favorable rate, repay the borrowed amount, and pocket the substantial difference. Given the pound’s overvaluation, the risk was minimal, as it was unlikely to strengthen without continued intervention. This created a low-risk, high-reward scenario, making it the perfect speculation opportunity for Soros.

The Black Wednesday

On the morning of September 15, 1992, Soros’s hedge fund launched a massive assault on the pound by shorting it heavily. By the end of the day, the Bank of England had exhausted over 600 million pounds in a futile attempt to uphold the currency’s value. Soros, however, continued selling pounds faster than the Bank could purchase them, applying relentless pressure on the exchange rate. The British government, realizing the severity of the situation, raised interest rates from 10% to 12% in a desperate bid to stabilize the pound. Nevertheless, Soros, sensing their desperation, persisted in his selling spree, further intensifying the pressure.

The Aftermath and Impact on Currency Markets

By the evening of September 16, 1992, the UK government conceded defeat, announcing that the country would withdraw from the ERM and abandon the fixed exchange rate. This decision led to a dramatic collapse in the pound’s value.

Soros had effectively shattered the UK’s monetary policy, earning over a billion dollars in profits in the process. This historic event, now known as Black Wednesday, underscored the power of speculative forces in the financial markets and demonstrated the vulnerabilities of fixed exchange rate systems. The repercussions were felt globally, prompting reevaluations of currency policies and strategies across nations.

George Soros executed one of the most legendary trades in financial history, earning over $1 billion in a single day.