As financial explorers, we keep a keen eye on different asset classes such as stocks, bonds, and real estate, among others. Our focus for this piece is on commodities, specifically, on platinum and palladium – two metals whose classification can be somewhat challenging. These precious elements are parts of the world’s asset spectrum and hold great potential for investors and analysts alike.

Classification of Platinum and Palladium

From an official standpoint, both platinum and palladium belong to the group known as the platinum group metals (PGMs), which also includes ruthenium, rhodium, osmium, and iridium. The PGMs have many similar properties, a common discovery history, and origins. However, this group broadens to include gold and silver, forming the precious metals category. These metals are relatively rare, corrosion-resistant, and carry high economic value.

Geographical Distribution

Geographically, platinum and palladium deposits are quite limited, contributing to their precious metal status. Interestingly, 74% of global platinum mining occurs in South Africa. The next largest contributor is Russia with 11%, followed by Zimbabwe with 8%. Each of these countries has its unique challenges, including corruption and poor infrastructure in South Africa and Zimbabwe, and ongoing military conflict in Russia. These factors often complicate platinum procurement for foreign consumers.

Global Palladium Production

Unlike platinum, palladium’s geographical production distribution is somewhat better diversified. Nevertheless, obtaining this metal isn’t always a straightforward process, given its equally sparse natural occurrence. Although palladium mining does not center as heavily in one region like platinum, challenges persist in accessing and procuring it.

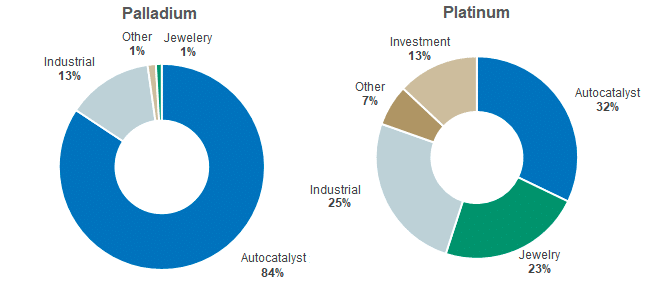

Platinum and Palladium in Catalyst Industry

Globally, platinum and palladium play a significant role in producing catalysts for internal combustion vehicles. In fact, catalyst production accounts for 84% of the total demand for palladium and 32% for platinum. Despite platinum currently being cheaper, catalyst producers prefer palladium for two reasons. Firstly, due to palladium’s better geographical diversification, procuring it incurs fewer disruptions. Secondly, manufacturers have already adapted their production lines to palladium, and switching to platinum would entail additional costs.

Historic Pricing

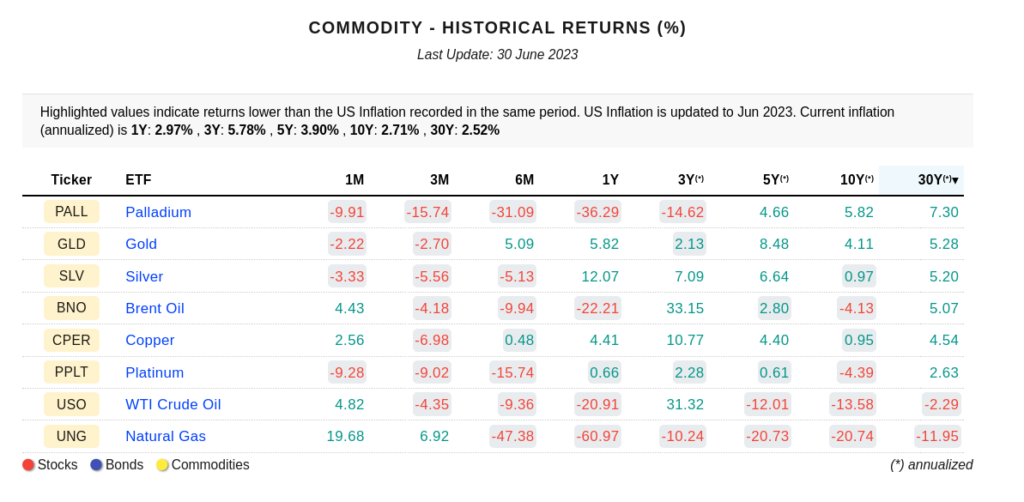

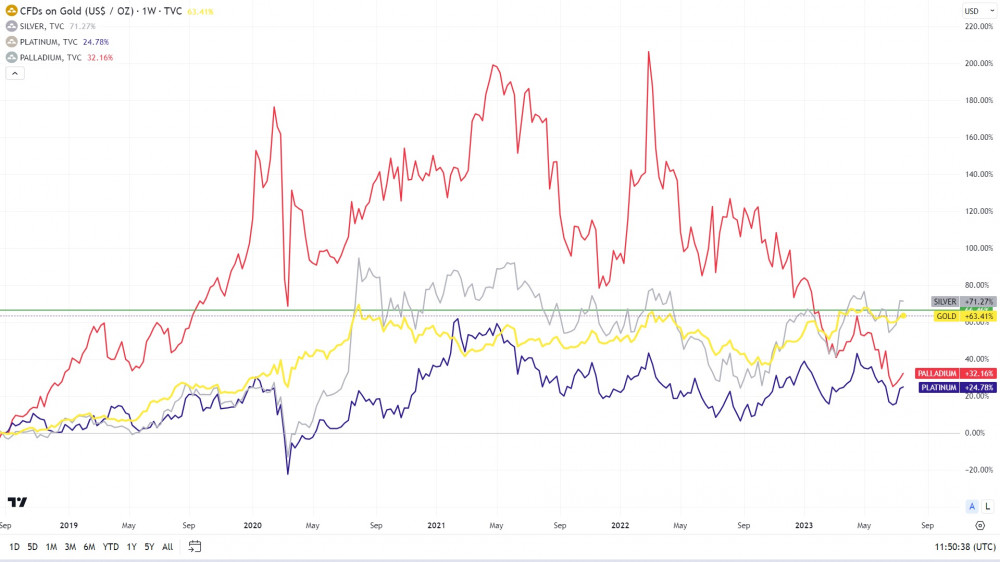

Historically, platinum was more expensive than palladium for a considerable duration. However, in recent years, palladium has maintained a higher price, largely due to the reasons outlined above. This trend has caught the attention of market observers and investors, as it influences the decision-making process for both current and prospective commodity investors.

The Hydrogen Revolution and Platinum

Platinum is set to play a crucial role in the burgeoning hydrogen revolution, serving as a catalyst in electrolyzers, the devices used for hydrogen production. As the world shifts away from combustion vehicles and gravitates towards hydrogen technology, the demand for palladium could decrease, while the need for platinum could rise. Geographical mining factors continue to influence these projections, but the trend towards cleaner, more sustainable energy sources cannot be ignored.

Current Market Situation for Platinum and Palladium

Evaluating the current market dynamics, July typically yields decent performance for both these metals. Platinum has recently rebounded robustly, whereas palladium appears to be stabilizing after a decline. Considering the recent investor sentiment data for platinum, the bottom seems to have been reached, implying that further downsides may be limited, and an upward movement could be on the horizon.

Information sources:

Sentiment Data Source

Hydrogen Revolution