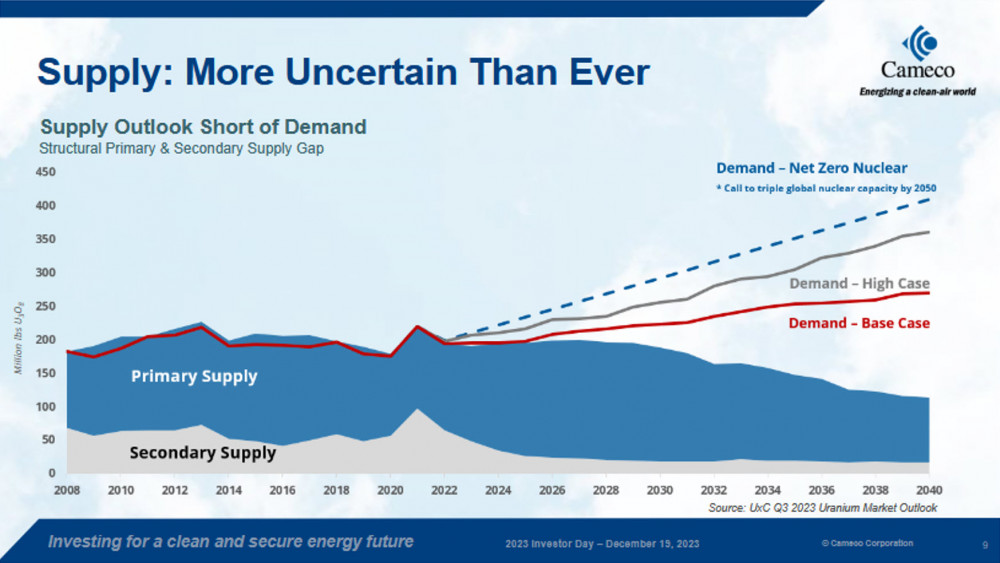

As of now, the spot market price for uranium stands at $89 per pound, marking the eighth year of a bullish trend that began in November 2016. The foundation of this sustained growth reflects robust fundamentals, which are better than ever, leading to an upsurge in uranium-related asset prices. Investors are reaping significant gains, prompting queries about the potential end of this bull run.

Is the Uranium Bull Run Over?

Definitely not! Critics who believe the peak has passed are likely comparing to historical nominal prices. From its 2016 low, uranium has surged by nearly 500%, with most of these gains occurring in the past two years. However, when adjusted for CPI inflation, the real peak would be around $200 per pound to match previous highs, indicating that prices could climb much higher based on strong fundamentals, such as the ongoing supply deficit forecasted for the coming years.

How to Invest in Uranium

Investment in uranium can be direct or through companies associated with its extraction. The volatility tolerance of an investor dictates the choice of investment vehicles, ranging from physical uranium funds to stocks in mining companies. Here, we explore several key players and funds in the uranium market:

Sprott Physical Uranium Trust – (U.U; U.UN)

This fund, established by Sprott in July 2021, manages assets worth $6.4 billion and has accumulated about 63.6 million pounds of uranium. It exerts a stabilizing effect on uranium prices by removing the purchased uranium from the market indefinitely.

Yellow Cake Plc – (YCA)

Listed on the London Stock Exchange, Yellow Cake has agreements allowing it to purchase $100 million worth of uranium annually from Kazatomprom, the world’s leading uranium producer. The company currently holds over 21 million pounds of uranium.

Global X Uranium ETF – (URA)

This ETF provides exposure mainly to uranium mining companies and has assets under management worth $2.75 billion. It is the largest and oldest uranium-focused ETF but has seen several portfolio adjustments over the years.

Sprott Uranium Miners ETF – (URNM)

With $1.77 billion under management, this ETF is preferred for its transparency and has shown favorable performance compared to physical uranium prices.

Exposure Through Uranium Companies

Investing directly in uranium extraction companies offers higher potential returns but comes with increased risk. Stock prices of these companies tend to fluctuate more significantly compared to the price of uranium itself. Choices range from industry giants like Cameco Corp. and Kazatomprom to smaller explorers and developers.

Summary

The uranium market is currently adjusting, with minor price corrections in raw uranium and more significant drops in company stocks. This situation presents a good opportunity to reconsider uranium exposure. The market has evolved from having only a couple of uranium ETFs a few years ago to a broader range of investment options today, including potentially leveraged instruments in the near future.