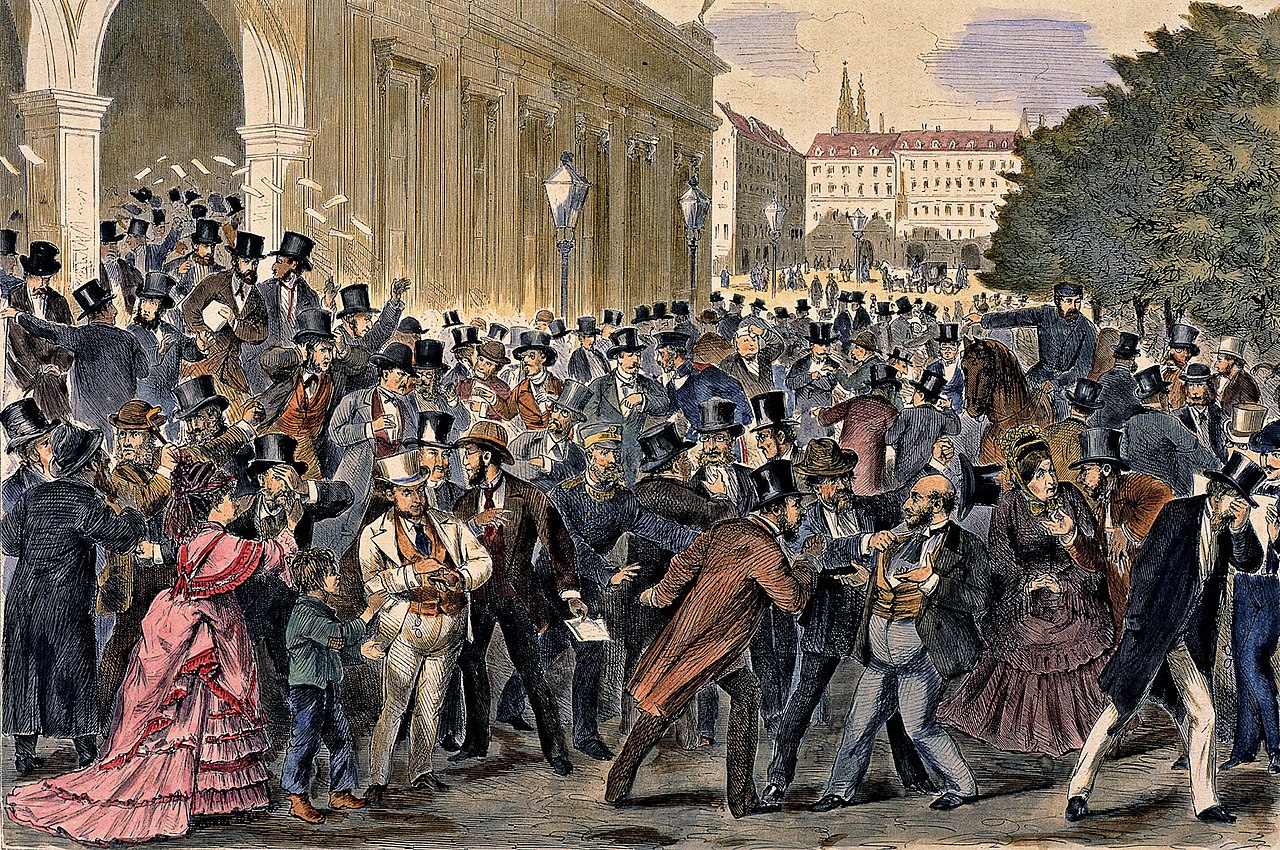

The crisis of 1873 is considered the largest crisis of the 19th century, and it started on the Vienna Stock Exchange due to a period of speculation. The crisis was unique because it did not originate in Great Britain but rather in continental Europe and the United States. The collapse of stocks and banks led to a prolonged period of weakened economic growth, causing many countries to depart from free trade policies and return to protectionist practices. The crisis lasted for over two decades and marked the caesura between the period of free-competitive capitalism and monopoly capitalism.

How It Happened

Chronologically, the crisis began in Vienna in the early 1870s, following the establishment of the Austro-Hungarian Empire and the rapid economic development that followed. Speculation reached its peak in the fall of 1872, and on May 1, 1873, Emperor Franz Joseph opened the Exhibition of the Flower Show in Vienna, followed by the collapse of stocks, especially in railroad companies.

The crisis quickly spread overseas, affecting countries like Germany and the United States. In the US, the panic began in the fall of 1873, with the New York Stock Exchange closing for ten days due to a wave of panic. The Jay Cook Company, a prominent financial institution, collapsed, leading to further bankruptcies and a sharp fall in railroad company stocks. The crisis contributed to rising unemployment and anti-immigrant sentiment, as many blamed immigrants for the economic downturn.

In other countries like France, the crisis was less severe, with no bank panic but a milder collapse in industry. Russia experienced a clear stagnation as early as 1872, while the City of Glasgow Bank in the UK collapsed in 1873. The crisis led to a questioning of free trade policies in many countries, with some introducing protective tariffs to shelter their economies from the impact of the downturn.

Consequences for the Global Economy

The consequences of the crisis were severe, and it had a significant impact on the global economy. The crisis resulted in a prolonged period of depression, unemployment, and public protests, leading to the rise of anti-immigrant sentiment and a questioning of free trade policies. Many countries introduced protective tariffs, and the crisis marked the caesura between the period of free-competitive capitalism and monopoly capitalism.

The Slow Path to Recovery

In the United States, President Ulysses S. Grant introduced a series of measures aimed at stimulating the economy, including the establishment of a commission to study the impact of protective tariffs on the economy. He also sought to promote the expansion of the railway system, believing that it would provide jobs and boost economic growth.

In Germany, Chancellor Bismarck introduced a series of social and economic reforms aimed at stimulating economic growth, including the expansion of the railway system and the introduction of protective tariffs. Bismarck also sought to strengthen the position of the working class, introducing social welfare programs that helped to reduce poverty and improve living standards.

In Austria-Hungary, politicians sought to promote economic growth by investing in infrastructure, including the construction of new rail lines and the expansion of the telegraph network. They also introduced protective tariffs to protect domestic industries from foreign competition.

How It Compares to Today’s Economy

Today’s economy faces many of the same challenges that were present during the crisis of 1873, including the impact of globalization and the rise of protectionism. However, we can learn from the crisis that government intervention in the free market is not always the best solution, and that allowing the market to correct itself can lead to a stronger and more resilient economy. The crisis also highlights the need for sustainable economic growth that benefits everyone, not just the privileged few.

The lessons learned from the crisis of 1873 are still relevant to today’s economy, and it is important that we take them into account as we navigate current economic challenges. We must continue to promote free trade and competition while also recognizing the need for regulations that ensure a level playing field for all market participants. By doing so, we can achieve sustainable economic growth that benefits everyone and avoids the pitfalls of excessive government intervention in the free market.