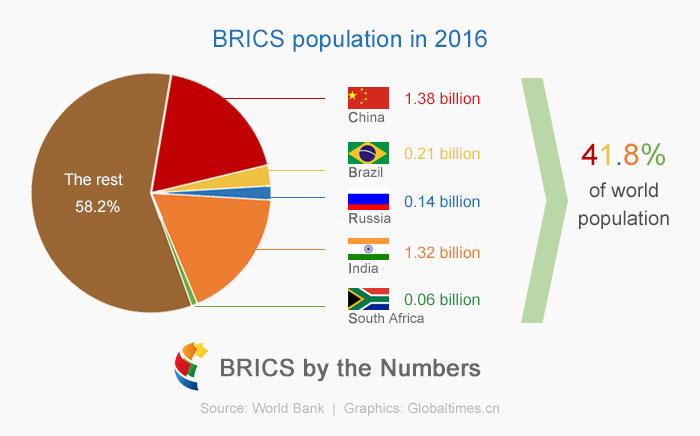

The growing discontent and insecurity about US actions have sparked a movement among countries to establish their own way of conducting international transactions that are independent of the US dollar. China’s push to make the renminbi a means of payment for oil, the ongoing development of a digital transaction currency called the m-CBDC Bridge, and the plan to create a reserve currency known as the “BRICS coin” are all part of this movement.

The United States is without a doubt the leading economy in the world, and holds a significant influence in the management of SWIFT, the global system for transmitting payment information. Their strong position has allowed the US to make the dollar the world’s reserve currency and the primary means of purchasing raw materials, known as the petrodollar. This has led to a constant demand for the US dollar and has given the US the ability to generate additional capital from printing. Over time, the US has begun to use their control over the dollar and SWIFT as a tool to punish countries that pose a threat to American interests. The destabilization of Iraq and Libya, and the loss of their leaders, is a well-known example of US intervention in foreign affairs.

WHAT WAS BRETTON WOODS ABOUT?

The Bretton Woods Conference was a meeting of representatives from all 44 Allied nations at the Mount Washington Hotel, located in Bretton Woods, New Hampshire, United States, to regulate the international monetary and financial order after the conclusion of World War II. The conference resulted in the creation of the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD), now known collectively as the World Bank. The U.S. dollar was fixed to gold at a rate of $35 per ounce, and other currencies were pegged to the dollar, making the dollar the world’s reserve currency. The Bretton Woods system continued until 1971, when the U.S. suspended the convertibility of the dollar to gold, effectively ending the fixed exchange rate system.

NIXON AND THE END OF GOLD STANDARD

In 1971, the U.S. government, under President Richard Nixon, ended the convertibility of dollars into gold, marking a transition to what is known as the Bretton Woods II system in Pozsar’s vision. This change meant that the dollar was no longer backed by gold, but instead was based on the notion that the U.S. government would ensure price stability. As a result, maintaining price stability became the primary responsibility of the Federal Reserve. However, in reality, the dollar was no longer backed by any tangible assets, leading to a surge in inflation during the 1970s.

THE NEW CHINESE BRETTON WOODS

Former Fed employee Zoltan Pozsar presented the vision of the emergence of Bretton Woods III as a commodity-based currency system for Eastern countries, with a prominent role for gold but also other raw materials and physical assets. According to Pozsar, this would weaken the dollar’s dominance and lead to pro-inflationary conditions in Western countries due to the reduced availability of commodities and raw materials. He summarized the system with the motto “our commodity, your problem.”

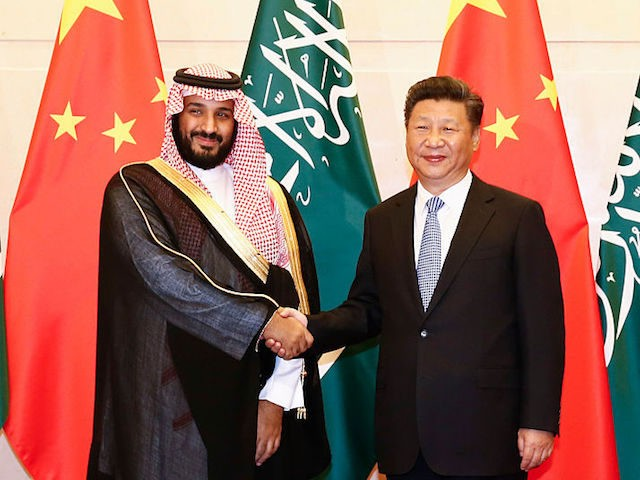

China, under the leadership of Xi Jinping, has declared its plans to deepen its partnership with the Gulf countries in the oil sector. In the next three to five years, China aims to expand cooperation in production, engineering, storage, transportation, and refining, with a goal of becoming the largest purchaser of oil and gas from the region. The country intends to pay for these resources in yuan, giving rise to the term “Petroyuan.”

China has been laying the foundation for this significant shift for quite some time. In 2016, it made the renminbi convertible to gold on the Shanghai and Hong Kong exchanges. The Central Bank of China has also expressed its eagerness in resuming gold purchases in 2022.

To illustrate, Venezuela has accepted payments in renminbi since 2019 and sells oil to China at a discounted rate. Iran and China have established a comprehensive strategic partnership in 2021, with China committing to investing $400 billion in Iran’s economy in exchange for a steady supply of oil. Iran and Russia both sell oil to China at a discounted rate, with these three countries collectively holding 40% of the world’s proven oil reserves.

IS IS THE END OF THE DOLLAR?

Due to the changes taking place in the system, we will see various types of tensions arising from the pursuit of control over resources and commodities. The phenomenon of “resource nationalism” will also intensify. For example, in early 2022, the president of Indonesia, Widodo, called for the creation of a cartel similar to OPEC in the field of metals used in the production of electric vehicle batteries. On November 3, 2022, Canada ordered three Chinese companies to stop lithium extraction on its territory.

From the perspective of an investor, I still believe that the dollar remains the main currency for purchases on financial markets. In case of a larger recession during 2023, the strength of the US currency may increase. If the dollar were to lose its position in the long term, we can protect ourselves in three ways:

1. Hold physical gold, which has survived hundreds of conflicts (it will also survive this one).

2. Add shares of stable resource companies to your portfolio, which will grow if the dollar weakens.

3. Hold part of your cash in Swiss francs, which is more stable in the long term than other currencies.