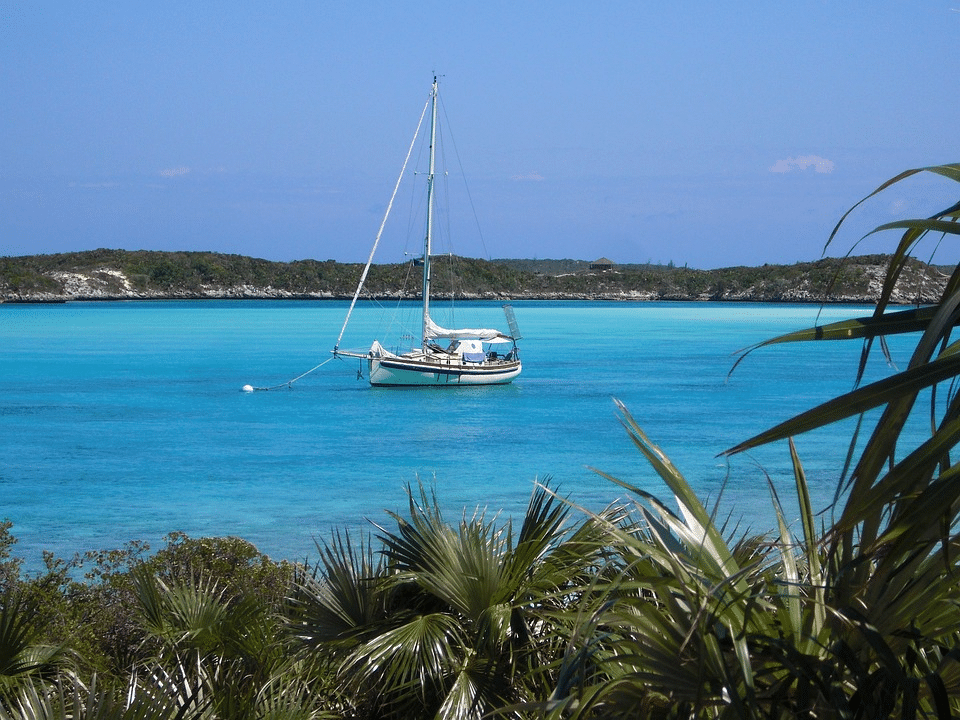

The Bahamas has always been a popular vacation spot for US citizens, but now it is becoming an increasingly attractive place to live. The combination of warm climate, sandy beaches, clear water, and tropical lifestyle, along with the lack of taxes for residents, makes the Bahamas an ideal destination for many expats. In this article, we will explore the benefits of living in the Bahamas for US citizens, the cost of living, and how to become a tax resident.

The Bahamas: An Overview

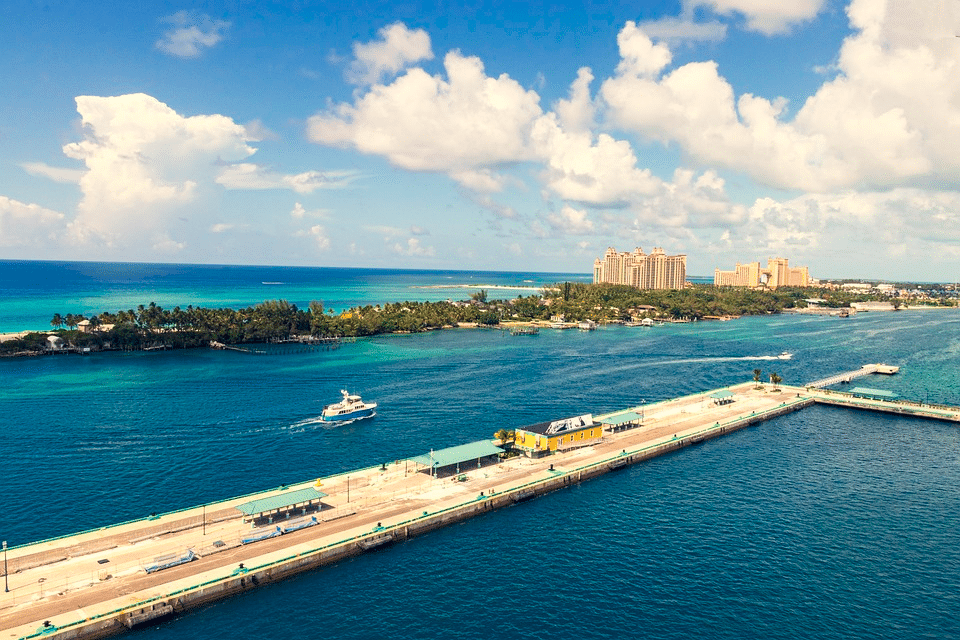

The Bahamas is an archipelago of over 700 islands, located southeast of Florida in the Atlantic Ocean. With a population of around 390,000, it is a relatively small country, but its natural beauty and strategic location make it an appealing destination for both tourists and expats alike.

Cost of Living and Renting in the Bahamas

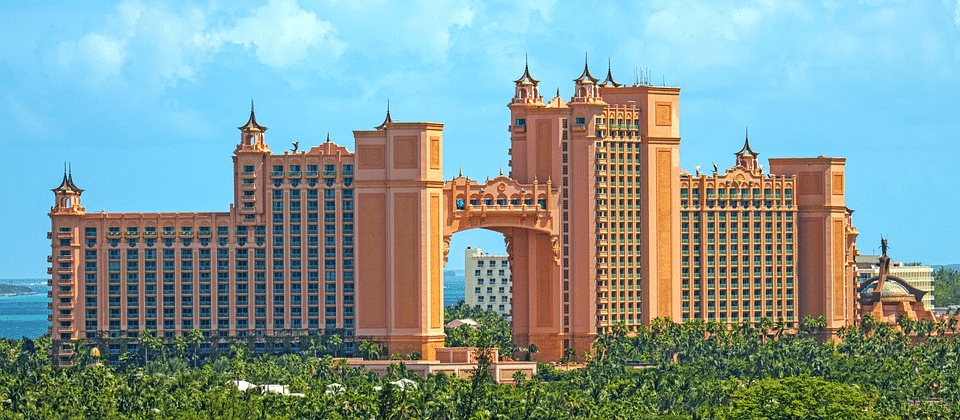

While the Bahamas is an attractive location, it does come with a high price point in terms of cost of living and obtaining residence. The cost of living in the Bahamas is approximately 26% higher than in the United States. To obtain residence, expats must make a minimum capital investment of $500,000, with those investing $750,000 to $1.5 million receiving expedited consideration for their applications. Renting in the Bahamas can also be expensive, with luxury properties costing thousands of dollars per month.

The Allure of Tax Residence in the Bahamas

One of the most significant benefits of living in the Bahamas is its tax-free jurisdiction. The Bahamas does not impose taxes on income, capital gains, dividends, interest, rent, wealth tax, estate tax, or royalties. Both individuals and companies can operate tax-free in the country. Furthermore, the Bahamas does not have any withholding tax, meaning that residents can live tax-free for the entire year, and their companies can also be tax-free.

How to Become a Tax Resident in the Bahamas

To become a tax resident in the Bahamas, you must spend at least 90 days per year in the country and maintain your investment. If you sell your property and don’t buy another one at the same price point, you will lose your residence status. In addition to the investment, you will also need to have a clean criminal record, copies of your passport, proof of financial capability, and character references.

Tax Benefits for US Citizens Living in the Bahamas

US expats living in the Bahamas can take advantage of the foreign earned income exclusion, which allows them to save at least $120,000 in tax-free money each year. Additionally, US citizens can claim the standard deduction and the foreign housing deduction or exclusion, depending on whether they are employed or self-employed. However, US citizens must still file taxes each year with the United States and pay any taxes due by April 15th, even if they are living in a foreign country like the Bahamas.

While the Bahamas is a tax-free country, US expats still have to worry about their US taxes. It is essential to work with a CPA to ensure that all necessary forms are filed and taxes paid on time. The standard income tax form for US citizens and resident aliens is Form 1040, which must be filed annually, even if living abroad. US expats also need to file an FBAR if they hold foreign bank accounts with a total value of $10,000 or more at any point during the tax year.

Permanent Residence in the Bahamas

For those looking to relocate from the United States without moving too far from home or complicating their tax situation, the Bahamas might be an ideal fit. Permanent residence is granted for the duration of your life, as long as you maintain your investment. This means that you can live and work in the Bahamas tax-free while enjoying the beautiful sandy beaches every day.

The Bahamian passport is also an attractive benefit for those considering living in the Bahamas. Although it takes ten years to obtain, it can allow you entrance to the United States if you decide to renounce your US citizenship. To qualify, you must have spent at least six years out of the ten in the country and 12 months preceding the date of application for citizenship. While the path to citizenship may be long, the benefits of permanent residence and tax residence are still accessible with little physical presence and maintenance.

Embracing the Bahamas as a New Home

The Bahamas offers an appealing combination of natural beauty, a relaxed lifestyle, and significant tax benefits for US citizens looking to relocate. With a tax-free jurisdiction, close proximity to the United States, and the possibility of obtaining permanent residence and tax residence with relative ease, the Bahamas is an increasingly attractive destination for expats. However, it is essential to work closely with professionals, such as CPAs and legal advisors, to ensure a smooth transition and compliance with tax laws.