Croatia is a country with a favorable tax system for small business owners and crypto investors. It is also a beautiful country with a low cost of living, making it an attractive option for those looking to relocate. In this article, we will explore the benefits of living in Croatia, the tax system, crypto rules and laws, how to obtain residence, the digital nomad visa, and how to become a citizen.

Option 1: Temporary stay permit

To obtain residence in Croatia, you will need to apply for a temporary stay permit, which is valid for up to one year, but can be renewed. You can apply for a temporary stay permit at the Croatian embassy or consulate in your home country, or at the police station in Croatia if you are already in the country. You will need to provide proof of accommodation, health insurance, and sufficient funds to support yourself, as well as a criminal record certificate. The cost of a temporary stay permit is around €200, which is affordable for most people.

Option 2: Digital nomad visa

Croatia has introduced a new digital nomad visa, which allows remote workers to live and work in Croatia for up to one year, with the possibility of extension. To qualify for the visa, you must be employed by a foreign company or be self-employed, and you will need to provide proof of income and health insurance. The digital nomad visa costs around €200, which is a small price to pay for the opportunity to live and work in one of Europe’s most beautiful countries.

Regular taxation

Croatia has a flat income tax rate of 24%, which is lower than many other European countries, making it an attractive option for small business owners and investors. Small business owners can benefit from a simplified tax system, with a fixed monthly tax of around €120 for those earning up to €7,500 per year, making it easier to manage their finances. There are also various deductions and exemptions available for businesses, providing further relief for entrepreneurs. Croatia has double taxation agreements with many countries, meaning that residents do not have to pay tax twice on the same income, which is beneficial for those who work or invest across borders.

Rules for crypto investors

Crypto investors in Croatia must comply with the same laws and regulations as traditional investors, ensuring a level playing field for all market participants. Cryptocurrencies are not considered legal tender in Croatia, but they are not banned either, which means that investors can legally hold and trade them.

Crypto transactions are subject to capital gains tax, which is currently set at 12% for individuals, making it one of the most favorable tax regimes for crypto investors in Europe. Croatia is working on new regulations for crypto exchanges, which are expected to come into force in 2022, providing further clarity and transparency for investors.

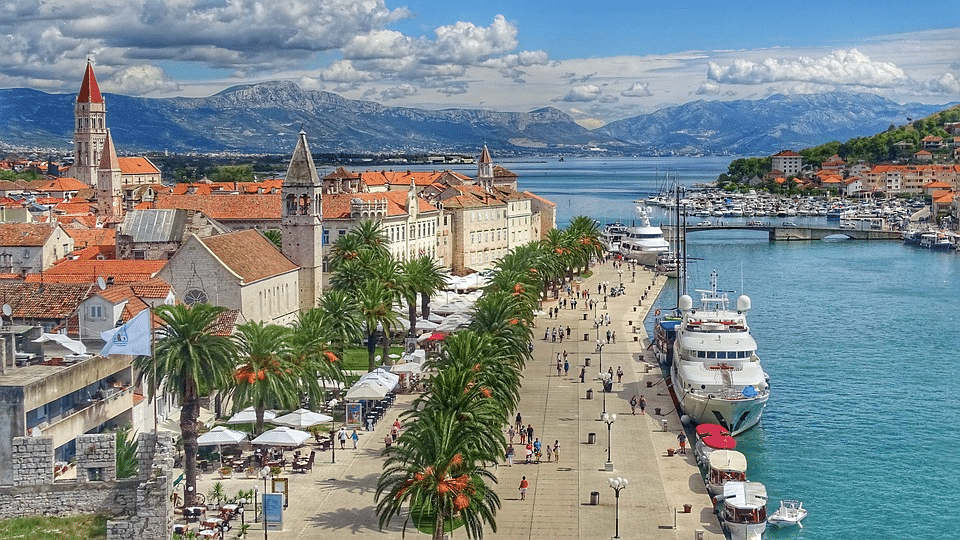

Living in Croatia

Croatia is known for its stunning landscapes, crystal-clear waters, and rich cultural heritage. The country boasts a low cost of living compared to other European countries, making it an affordable place to live. Croatia also has a favorable climate, with hot summers and mild winters. The country is home to many historic cities, such as Dubrovnik and Split, as well as beautiful coastal towns and islands.

The path to citizenship

To become a citizen of Croatia, you must have lived in the country for at least eight years and have a valid residence permit, demonstrating your commitment to the country. You must also pass a Croatian language test and a citizenship test, which assess your knowledge of the country’s history, culture, and laws. The cost of citizenship is around €2,000, which is a significant investment, but it grants you the right to vote and access to social services.

Croatia also offers a fast-track citizenship program for investors, which requires a minimum investment of €100,000 in a Croatian business, providing an alternative path to citizenship for those who are willing and able to make a significant contribution to the country’s economy.