In general, the 183-day rule dictates that individuals must pay taxes in the country they reside in for more than half of the year. While the specific requirements vary among countries, the standard timeframe is based on a 12-month period with 183 days as the benchmark. However, some countries have extended tax liability periods beyond 183 days, while others allow for tax residency in a shorter timeframe. Today, we’ll explore both types of countries and the implications for global citizens’ tax obligations.

Days count is not everything

It is important to note that the number of days spent in a country is not the sole factor in determining tax residency. Many countries also consider whether your new place of residence is truly the center of your life, taking into account factors such as strong ties to the country.

Simply leaving your home country may not be sufficient to establish tax residency in a new location. For example, if you still have a key to your old apartment or if your family (such as your spouse and dependent children) still reside there, the government may view your old country as the center of your life.

To successfully change your tax residency, you must not only meet the length-of-stay requirements but also demonstrate that your new country is truly the center of your life. It is important to take steps to avoid being considered a resident of your country of origin to minimize tax obligations.

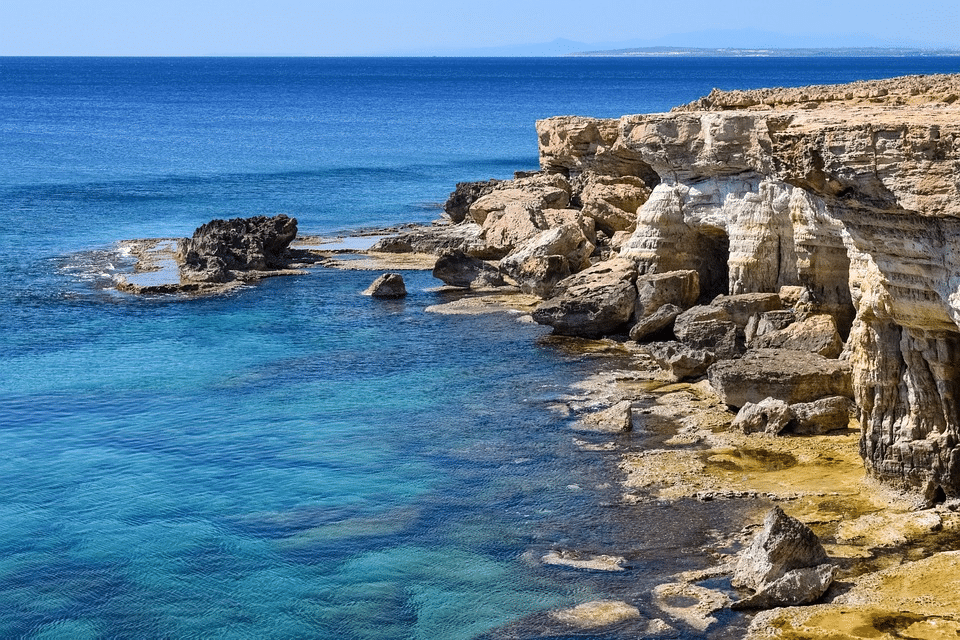

Cyprus

Cyprus is a highly attractive tax option for EU citizens due to its fast-track tax residency process, requiring just 60 days of stay in the country.

To qualify for tax residency, in addition to meeting the minimum stay requirement, individuals must fulfill the following criteria:

- Not exceed 183 days of stay in another country

- Not be considered a tax resident in any other country

- Have a permanent residence in Cyprus

- Demonstrate strong ties to Cyprus through employment, self-employment, management of a Cyprus company, or having a partner residing in the country.

Days spent outside Cyprus are not included in the total number of days counted towards tax residency.

Cyprus offers not just a favorable tax regime, but also ample opportunities and a high quality of life on a large island.

Malta

Malta offers a non-dom system similar to Cyprus and also adheres to the 183-day rule. EU citizens who are beneficiaries of The Residence Program or non-EU citizens under The Global Residence Program must spend no more than 183 days outside of Malta.

As a High Net Worth Individual (HNWI), however, a minimum stay of only three months is required in the first year of registration on the island. Subsequently, there is a tax certificate with no minimum stay required if the individual is only present on the island occasionally.

However, a flat tax of €15,000 per year must be paid, and the individual must either own an apartment worth at least €350,000 or rent one for at least €20,000 per year.

Retirees may qualify for reduced requirements of just €9,600 in rent and €7,500 in flat tax. Malta can be an attractive option for retirees, particularly due to its extensive network of double taxation agreements that reduce withholding taxes and often make pensions tax-free in the individual’s country of origin.

Applicants must pay a non-refundable application fee of several thousand euros, as well as considerable attorney fees for the application process.

Malta also offers a great citizenship by investment program outlined more previously in this article.

Georgia

Georgia, like Malta, applies the 183-day rule in most cases, but offers a High Net Worth Individual (HNWI) program that departs from this rule. HNWI status exempts individuals from the minimum residency requirement in Georgia, allowing for immediate application for a certificate of tax residence regardless of time spent in the country.

To qualify for HNWI status, individuals must meet one of two criteria:

- Income: Individuals must show evidence of earning at least 200,000 GEL (approx. €60,000) per year for the past three years, which can be from domestic or foreign sources.

- Wealth: Individuals must invest a minimum of 3,000,000 GEL (approx. €880,000) in Georgia, which can be in real estate, financial products such as government bonds, or time deposits in a Georgian bank.

One of the most notable features of Georgia’s immigration policy is its 1-year entry rule, which allows citizens of most countries to enter and stay in Georgia for up to a year without a visa. I wrote a separate article about it here.

Gibraltar

Gibraltar typically follows the 183-day rule, but Category 2 permit holders can obtain a certificate of tax residency without a minimum residency requirement. However, they must pay a flat tax between £22,000 and £28,000 based on their income.

To settle in Gibraltar, one can become self-employed, establish a company in Gibraltar, or show proof of sufficient assets. Additionally, individuals must have health insurance with a minimum coverage of £100,000 and either own or rent property in Gibraltar, including boats that sail under the Gibraltar flag.

To qualify for a Category 2 permit as a non-UK national, individuals must meet the aforementioned conditions and demonstrate assets of at least £2 million.

Honduras

Honduras presents a unique opportunity for businesses seeking to establish themselves in a thriving economic zone. The country offers a favorable territorial tax system, making it an attractive destination for foreign investment.

For individuals seeking to establish tax residency in Honduras, the requirement is a stay of more than 90 days during a tax year, regardless of whether it is continuous or not. This favorable residency requirement makes Honduras an appealing destination for those seeking to relocate for business or personal reasons.

Ireland

In addition to the 183-day rule, some countries, such as the USA and Ireland, apply an additional criterion for determining tax residency based on the number of days spent in the country in previous years. In Ireland, individuals are considered tax resident if they spend a total of 280 days or more in the current and previous year, of which at least 30 days are in each year.

Several other countries, including India, Israel, Lithuania, Mauritius, Norway, and Kenya, also follow similar models to Ireland and the US by including the total number of days spent in the country in previous years as a factor in determining tax residency. These additional criteria ensure that individuals who frequently spend extended periods in a country are subject to taxation on their worldwide income, making it important for those seeking to become tax residents in these countries to carefully track their days of presence.

Paraguay

Through Paraguay‘s territorial taxation system, individuals can enjoy an excellent standard of living without paying taxes in the country. To qualify, one must spend at least 120 days in the country within a single fiscal year.

Overall, Paraguay’s combination of favorable taxation, ease of residency, and freedom of movement makes it an appealing destination for those seeking a flexible and advantageous lifestyle.

Switzerland

Switzerland offers a straightforward and efficient process for individuals seeking tax residency. A stay of at least 90 consecutive days per year (excluding short absences) is considered tax residency, and the intention to establish habitual residence and register with the municipal and cantonal authorities also counts.

For non-taxpayers in Switzerland, income is only taxed if it originates from within the country. With a withholding tax rate of 35%, individuals who run Swiss companies can optimize their tax liability through a holding company to avoid potential tax traps.

Overall, Switzerland’s favorable taxation policies and straightforward residency process make it a desirable destination for those seeking a beneficial tax environment.

United Kingdom

Becoming a tax resident in the UK requires meeting the Statutory Residence Test (SRT), which consists of four criteria established by the UK government. The simplest criterion is the days test, which requires a stay of at least 60 days in the country if you have no other tax residence.

In addition to the tax residency test, the UK applies automatic tests to non-residents. Notably, if an individual spent less than 16 days in the UK in the current year but was resident for one or more of the previous three tax years, they are no longer considered tax resident.

Overall, the UK’s residency process is straightforward and offers several automatic tests to determine tax residency. These criteria make it an appealing destination for individuals seeking a beneficial tax environment in the country.

United States

The process of becoming a tax resident in the United States is similar to that in the UK, with a comparable test known as the substantial presence test. Unlike the UK’s SRT, the substantial presence test in the US combines two criteria. If an individual has resided in the US for at least 31 days in the current year and a total of 183 days in the current year and the previous two years (excluding short absences), they are considered a tax resident.

To calculate the number of days, an individual must add up the days spent in the US in the current year, plus 1/3 of the days from the previous year and 1/6 of the days from two years prior. If this total exceeds 183 days, worldwide income becomes subject to US taxation. It’s important to note that US green card holders are also considered taxpayers, and this status is retained until the green card is formally returned.

Overall, the substantial presence test in the US offers a straightforward process for determining tax residency, making it an appealing destination for individuals seeking a beneficial tax environment in the country.