It’s February 2023 and with Europe, or at least part of it, at war. To preserve the current global state, the West faces multi-trillion dollar investments in the next decade. Three trends have surfaced in the year: energy independence from Russia/China, electrification and the arms sector. To excel in these, diverse strategies and materials are necessary, and these are my top picks for the most promising prospects in 2023.

URANIUM

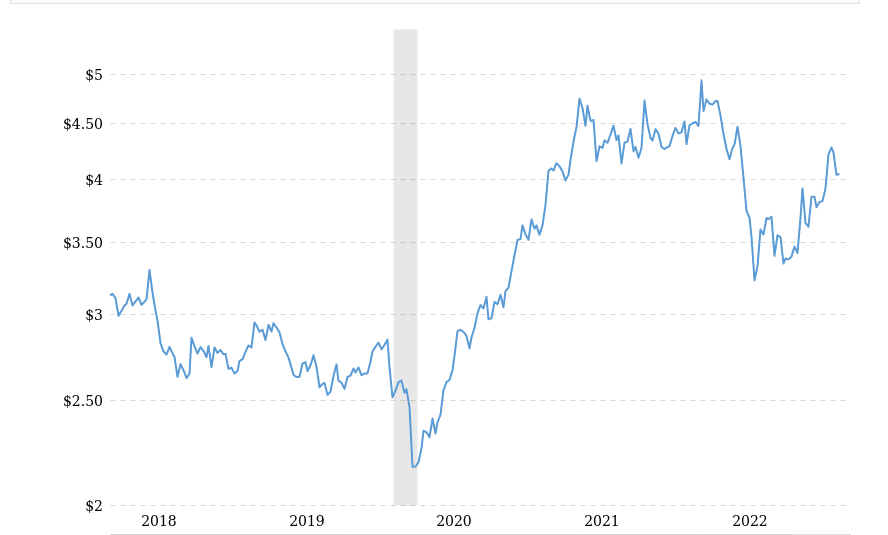

Throughout 2022, the uranium market experienced a significant improvement in its fundamentals while its spot price hovered around $50 per pound. There were numerous positive reports, including:

- Germany and Belgium’s decision to extend the lifespan of their reactors,

- Britain’s creation of a fund to support nuclear fuel production as an alternative to imported raw materials from Russia,

- Japan, among others, extending the operation of their reactors, indicating a change in sentiment following the Fukushima disaster,

- The U.S. Department of Energy awarding the first contracts to domestic producers for the supply of uranium for its strategic reserves.

Despite the abundance of positive news, the URNM ETF trended downwards for most of the year, but uranium companies performed better than the S&P500 index, as shown on the chart by the SPY ETF.

In conclusion, the uranium outlook for 2023 is promising, with expectations of the commodity’s price remaining above $50 per pound. This bodes well for the uranium industry, which has significant potential for growth.

RARE EARTH METALS

The competition for metals between the West and East is particularly intense when it comes to rare earth metals, where China holds a monopoly in mining and processing. To mitigate this dependency, Western nations are taking steps to establish their own supply chain.

Examples include plans to construct refining and separation facilities for rare earth elements in the US and Australia, and the establishment of the Minerals Security Partnership (MSP). The MSP, comprising countries such as the US, Australia, Canada, Finland, France, and South Korea, among others, seeks to secure its members’ access to critical raw materials. This partnership will facilitate government and private sector investments in projects related to the extraction and processing of rare earth elements and other strategic minerals.

I predict that companies that play a key role in creating this alternative supply chain will reap long-term benefits.

COPPER

The transition to electrification will drive up demand for copper. By 2025, electric vehicles are

projected to occupy a quarter of the global automobile market, and they require three times more copper than vehicles with internal combustion engines, not to mention the necessary charging infrastructure.

Renewable energy sources like wind and solar are even more copper-intensive, with offshore wind farms consuming five times more copper than traditional power plants, and solar installations requiring more than double the copper compared to conventional power plants.

Projections show that copper demand will increase from 25 million tons to approximately 50 million tons by 2050. Despite this growing demand, copper remains in short supply due to under investment in new discoveries and domestic issues in leading copper-producing countries such as Chile and Peru.

Currently, the annual production of copper is around 25 million tons, and it’s estimated that an additional 10 million tons of supply will be required in the next decade to meet demand.

Given these factors, I believe that copper has the potential to perform well in 2023, even in the face of an economic downturn.